Financial priorities significantly shifted during the lockdown, with more people re-evaluating their investments. Consequently, the stock market saw retail investors flocking in with high hopes of making humongous profits. Cut to a couple of years later, the National Stock Exchange (NSE) reported a whopping 53 lakh drop in active clients in the last nine months. What could’ve caused it?

So, what do the stats look like? So what are the numbers and statistics behind the decline in NSE users?

In March, the active client count on the National Stock Exchange (NSE) witnessed its ninth consecutive monthly decline, reaching 3.27 crore. This marked a significant decrease of 53 lakhs compared to the 3.8 crore investors recorded in June 2022.

What caused the decline in number of active traders?

While business had slowed down during the pandemic and work had taken a pause for a bit, people had ample amount of time in hand to research and build their portfolios. The return to work from office routine has reduced the amount of time and attention people have available for investing, leading to a decrease in trading activity.

Trading actively also requires a lot of research and analysis. With limited time after starting work from the office, this factor, too, would have demotivated the traders.

Due to this, there have been certain implications in the trading landscape. Trading volume and competition have decreased, and people are now focusing on long-term investments for stable growth. It has resulted in new opportunities for new traders.

People working from the office shouldn’t let their investments and trading take a back seat, as there are services like ready-made portfolios by Stoxbox that make management a lot simpler. With registered professionals curating tailored portfolios based on legitimate research, investors can sit back and relax and see their wealth grow.

Now the question is – should people endure the volatility of the stock market or move towards alternative investments? Well, the answer is not so simple. The decision depends on an individual’s risk tolerance, financial goals, and investment horizon. Let’s look at both situations in detail.

Alternate Forms of Investment:

Pros:

- Portfolio Diversification: Investing in different asset classes (such as stocks, bonds, real estate, or commodities) can help reduce risk and the impact of volatility in a particular investment.

- Potential for higher returns: Some alternate forms of investment, such as high-growth stocks or emerging markets, may offer greater potential for higher returns compared to traditional investments.

- Hedging against inflation: Certain alternative investments, such as gold or real estate, can act as a hedge against inflation and preserve purchasing power.

Cons:

- Higher risk: Alternate forms of investment often come with higher risks due to factors like limited regulation, market unpredictability, and illiquidity. It’s important to thoroughly research and understand the risks associated with any investment before committing funds.

- Complexity: Many alternative investments require specialised knowledge or access to specific markets, making them more complex to understand and evaluate.

Enduring Volatility:

Pros:

- Long-term growth potential: Historically, markets have tended to recover from downturns and deliver long-term growth. By staying invested through periods of volatility, investors can benefit from market recoveries and potentially earn higher returns.

- Cost averaging: Volatility allows for opportunities to purchase assets at lower prices, potentially increasing overall returns when the market rebounds.

- Less need for active management: Choosing to endure volatility may suit investors who prefer a passive investment strategy, avoiding the need for frequent buying and selling decisions.

Cons:

- Emotional stress: Enduring market volatility requires a strong emotional mindset, as it can be stressful to witness fluctuations and potential temporary losses in investment values.

- Short-term losses: In the short term, volatility can result in portfolio losses, which may cause financial strain if funds are needed urgently.

- Uncertainty and timing: It is challenging to predict market movements accurately. Remaining invested during periods of volatility means accepting the uncertainty of when the market will recover and potentially regain lost value.

Ultimately, individuals should carefully assess their financial situation, risk tolerance, and investment goals before deciding whether to explore alternative forms of investment or endure volatility. It’s advisable to consult with a financial advisor who can provide personalised guidance based on your specific circumstances or read more about the market. A mentor can offer valuable insights during such tricky situations.

You might also Like.

City Union Bank Quarterly Result Update

Originally known as The Kumbakonam Bank Limited, City Union Bank...

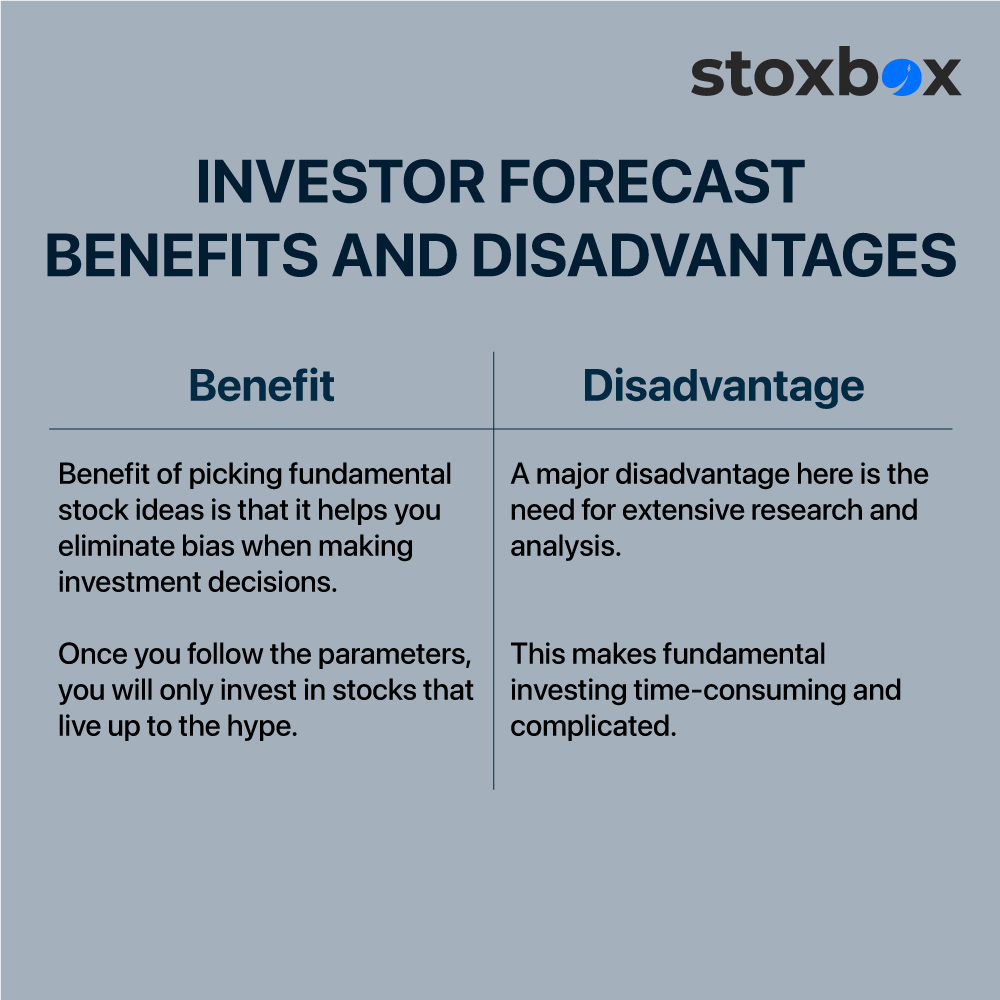

So, should you choose fundamental investing while creating your portfolio? Here is a comprehensive list of the benefits and disadvantages of the practice to help you decide. The first benefit of picking fundamental stock ideas is that it helps you eliminate bias when making investment decisions. Once you follow the parameters, you will only invest in stocks that live up to the hype. Secondly, the combination of qualitative and quantitative analysis ensures that you have the complete picture – of the company’s performance, as well as the sectoral and macro-economic factors impacting its future outlook. This helps you make more informed decisions based on logic and reasoning. Fundamental analysis also enables you to pick high potential stocks for longer-term investment, helping you grow your wealth sustainably.

While there are no risks to fundamental investing, a major disadvantage here is the need for extensive research and analysis. This makes fundamental investing time-consuming and complicated. If you are not a seasoned investor with a keen eye for the fundamentals, you could end up being confused by the many factors that need to be analysed. Further, many a times, the qualitative fundamentals can be very subjective, and you may find yourself unsure about the actual value of the stock pick. These disadvantages make investors vary of the approach and they end up not following it properly.

Considering the various benefits inherent in the fundamental approach to investing, it is one of the essential aspects to consider while building your portfolio. However, if you are not keen on undertaking voluminous research or finding fundamental stock picks from the vast ocean of listed companies, worry not. You can simply choose to invest in curated portfolios which follow the fundamental approach and benefit from the expertise and experience offered by professional fund managers.

So, should you choose fundamental investing while creating your portfolio? Here is a comprehensive list of the benefits and disadvantages of the practice to help you decide. The first benefit of picking fundamental stock ideas is that it helps you eliminate bias when making investment decisions. Once you follow the parameters, you will only invest in stocks that live up to the hype. Secondly, the combination of qualitative and quantitative analysis ensures that you have the complete picture – of the company’s performance, as well as the sectoral and macro-economic factors impacting its future outlook. This helps you make more informed decisions based on logic and reasoning. Fundamental analysis also enables you to pick high potential stocks for longer-term investment, helping you grow your wealth sustainably.

While there are no risks to fundamental investing, a major disadvantage here is the need for extensive research and analysis. This makes fundamental investing time-consuming and complicated. If you are not a seasoned investor with a keen eye for the fundamentals, you could end up being confused by the many factors that need to be analysed. Further, many a times, the qualitative fundamentals can be very subjective, and you may find yourself unsure about the actual value of the stock pick. These disadvantages make investors vary of the approach and they end up not following it properly.

Considering the various benefits inherent in the fundamental approach to investing, it is one of the essential aspects to consider while building your portfolio. However, if you are not keen on undertaking voluminous research or finding fundamental stock picks from the vast ocean of listed companies, worry not. You can simply choose to invest in curated portfolios which follow the fundamental approach and benefit from the expertise and experience offered by professional fund managers.

The short answer is wealth creation. Your salary can only get you so far. The rest of the gap can be covered with disciplined savings and investments. By investing your money, you allow it to multiply and grow over time. You also save it from getting robbed by inflation, which can eventually render your savings less valuable. However, being a young, independent individual translates to a hectic schedule in today’s times. This probably means you may not always have the time to invest in options like direct equities, where you have to build your portfolio yourself, time the market, and devise exit strategies. This is where ETFs come in as the ideal investment option.

What are ETFs?

ETFs are like a big hamper of different securities, including stocks, bonds, and commodities that tracks an underlying index. This means that an ETF follows a benchmark index and tries to replicate its performance. An ETF in India is a combination of a stock and a mutual fund. It is traded on the stock exchanges like stocks. It is also highly liquid like shares and can be bought and sold throughout the day. This means you can buy and sell units of ETFs from the stock market anytime you want.

The short answer is wealth creation. Your salary can only get you so far. The rest of the gap can be covered with disciplined savings and investments. By investing your money, you allow it to multiply and grow over time. You also save it from getting robbed by inflation, which can eventually render your savings less valuable. However, being a young, independent individual translates to a hectic schedule in today’s times. This probably means you may not always have the time to invest in options like direct equities, where you have to build your portfolio yourself, time the market, and devise exit strategies. This is where ETFs come in as the ideal investment option.

What are ETFs?

ETFs are like a big hamper of different securities, including stocks, bonds, and commodities that tracks an underlying index. This means that an ETF follows a benchmark index and tries to replicate its performance. An ETF in India is a combination of a stock and a mutual fund. It is traded on the stock exchanges like stocks. It is also highly liquid like shares and can be bought and sold throughout the day. This means you can buy and sell units of ETFs from the stock market anytime you want.

Further, it pools money from different investors, as in the case of mutual funds. The fund manager invests your money further, and the profits are given back to you as returns. ETFs also have a Net Asset Value (NAV) like mutual funds.

Some ETF examples in India include the Nippon ETF Nifty BeES, LIC MF ETF – CNX Nifty 50, and ICICI Prudential Nifty ETF, among several others. [SS1] There are also different types of ETFs like equity ETFs, gold ETFs, bond ETFs, and international ETFs. You can invest in any of these based on your financial goals.

The past, present, and future of ETFs

The Nifty Benchmark Exchange-Traded Scheme (Nifty BeES) was the first-ever ETF in India introduced in 2001. It was offered by the Benchmark Mutual Fund. This was followed by Liquid BeES in 2004, the first debt ETF in the country. However, ETFs really thrived after the economic crisis of 2008 that engulfed the world. ETFs presented investors with comparatively more security and thus appealed to beginners and experts alike.

According to AMFI, asset under management (AUM) for ETFs grew by 1345.77% between 2015 and 2020 in the country1. There was a further increase of 136% in ETF AUM between 2020 and 2022, stated a survey report by Morningstar India2. These rising numbers are testament to the fact that ETFs are attracting many investors and are indeed here to stay.

ETF benefits

Further, it pools money from different investors, as in the case of mutual funds. The fund manager invests your money further, and the profits are given back to you as returns. ETFs also have a Net Asset Value (NAV) like mutual funds.

Some ETF examples in India include the Nippon ETF Nifty BeES, LIC MF ETF – CNX Nifty 50, and ICICI Prudential Nifty ETF, among several others. [SS1] There are also different types of ETFs like equity ETFs, gold ETFs, bond ETFs, and international ETFs. You can invest in any of these based on your financial goals.

The past, present, and future of ETFs

The Nifty Benchmark Exchange-Traded Scheme (Nifty BeES) was the first-ever ETF in India introduced in 2001. It was offered by the Benchmark Mutual Fund. This was followed by Liquid BeES in 2004, the first debt ETF in the country. However, ETFs really thrived after the economic crisis of 2008 that engulfed the world. ETFs presented investors with comparatively more security and thus appealed to beginners and experts alike.

According to AMFI, asset under management (AUM) for ETFs grew by 1345.77% between 2015 and 2020 in the country1. There was a further increase of 136% in ETF AUM between 2020 and 2022, stated a survey report by Morningstar India2. These rising numbers are testament to the fact that ETFs are attracting many investors and are indeed here to stay.

ETF benefits

Here are some ETF benefits that can help you make the decision to invest in them:

Here are some ETF benefits that can help you make the decision to invest in them:

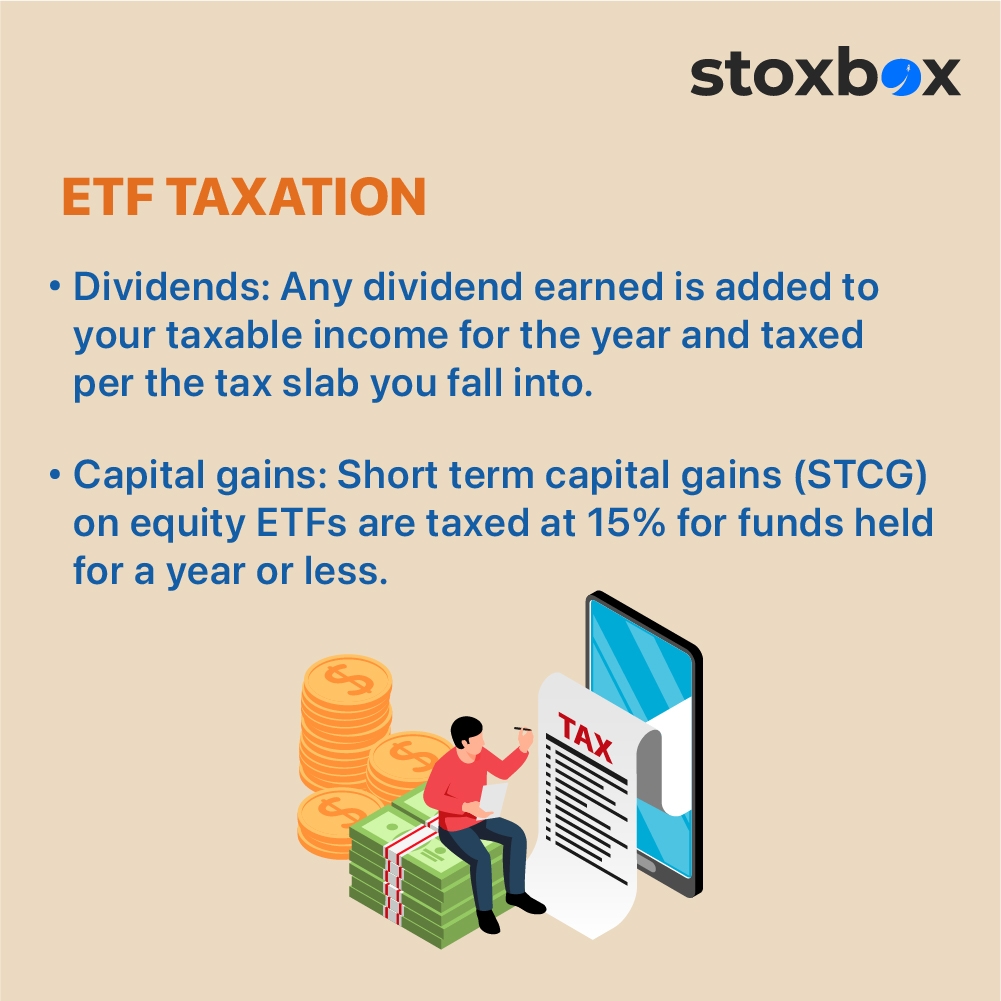

To understand ETF taxation, you first need to know that there are two types of incomes that you can earn from investing in an ETF in India – a dividend and a capital gain. Here’s how each of these is taxed:

To understand ETF taxation, you first need to know that there are two types of incomes that you can earn from investing in an ETF in India – a dividend and a capital gain. Here’s how each of these is taxed: