All You Must Know About the Fundamental Approach to Investing

Take a look around yourself – what are the fundamental or core aspects that define you as a person? Is it your educational qualification, which enables you to take up a job you enjoy? Is it the books you read or the shows you binge watch? Maybe it is the cuisine you consider comfort food. Or the memorabilia you collect when on a trip. There are so many fundamental ideas that you carry with yourself in this journey called life. They mould the way you perceive the world, while also helping people gain a perception of who you are. Just as these fundamentals form your identity, there are some fundamental elements which define a strong investing strategy.

What is fundamental investing?

The fundamental approach to investing involves picking stocks based on the intrinsic value of the underlying company. When considering fundamental stock ideas, you must remember that while many factors can impact the price of a stock, one of the most crucial factors is the fundamental status of the company. Fundamental analysis involves the process of measuring the intrinsic value of a stock to decipher whether your pick is valued fairly and correctly. You can undertake fundamental analysis by studying the company’s financial statements, valuation ratio, and other qualitative metrics, while also keeping an eye on the management structure and macro aspects such as the industry outlook and government policies. When picking a stock to invest in, it is important to know these underlying fundamental aspects, as these help you gain an idea about how the stock will perform over the longer-term.

For instance, you may consider investing in a stock that is in the news for its high quarterly earnings. But, is that enough? What if the profit margin is high because the base was low last year? Will the stock manage to hold on to its gains if the management structure is not stable? How will the rise in inflation, or the repo rate, affect the stock’s future? These are basic questions which will help you ascertain the stock’s underlying fundamentals and, thereby, its fair value.

Approaches to fundamental investing

While choosing your fundamental stock ideas, consider three broad metrics – company-specific aspects, industry, and the overall economy. If even one of these factors fail you, the stock may end up losing value. While analysing these three metrics, you must keep an eye on both qualitative and quantitative factors. Qualitative factors include intangibles like the quality and stability of the management, market reputation, business model, corporate governance, etc. Quantitative factors can be measured through data and consist of aspects such as financial statements, competition, market penetration, industry growth, etc. Deep research and thorough analysis of these aspects will help you decode your fundamental stock ideas and help you position yourself for long-term profit.

Investor Forecast – Benefits and Disadvantages

So, should you choose fundamental investing while creating your portfolio? Here is a comprehensive list of the benefits and disadvantages of the practice to help you decide. The first benefit of picking fundamental stock ideas is that it helps you eliminate bias when making investment decisions. Once you follow the parameters, you will only invest in stocks that live up to the hype. Secondly, the combination of qualitative and quantitative analysis ensures that you have the complete picture – of the company’s performance, as well as the sectoral and macro-economic factors impacting its future outlook. This helps you make more informed decisions based on logic and reasoning. Fundamental analysis also enables you to pick high potential stocks for longer-term investment, helping you grow your wealth sustainably.

While there are no risks to fundamental investing, a major disadvantage here is the need for extensive research and analysis. This makes fundamental investing time-consuming and complicated. If you are not a seasoned investor with a keen eye for the fundamentals, you could end up being confused by the many factors that need to be analysed. Further, many a times, the qualitative fundamentals can be very subjective, and you may find yourself unsure about the actual value of the stock pick. These disadvantages make investors vary of the approach and they end up not following it properly.

Considering the various benefits inherent in the fundamental approach to investing, it is one of the essential aspects to consider while building your portfolio. However, if you are not keen on undertaking voluminous research or finding fundamental stock picks from the vast ocean of listed companies, worry not. You can simply choose to invest in curated portfolios which follow the fundamental approach and benefit from the expertise and experience offered by professional fund managers.

So, should you choose fundamental investing while creating your portfolio? Here is a comprehensive list of the benefits and disadvantages of the practice to help you decide. The first benefit of picking fundamental stock ideas is that it helps you eliminate bias when making investment decisions. Once you follow the parameters, you will only invest in stocks that live up to the hype. Secondly, the combination of qualitative and quantitative analysis ensures that you have the complete picture – of the company’s performance, as well as the sectoral and macro-economic factors impacting its future outlook. This helps you make more informed decisions based on logic and reasoning. Fundamental analysis also enables you to pick high potential stocks for longer-term investment, helping you grow your wealth sustainably.

While there are no risks to fundamental investing, a major disadvantage here is the need for extensive research and analysis. This makes fundamental investing time-consuming and complicated. If you are not a seasoned investor with a keen eye for the fundamentals, you could end up being confused by the many factors that need to be analysed. Further, many a times, the qualitative fundamentals can be very subjective, and you may find yourself unsure about the actual value of the stock pick. These disadvantages make investors vary of the approach and they end up not following it properly.

Considering the various benefits inherent in the fundamental approach to investing, it is one of the essential aspects to consider while building your portfolio. However, if you are not keen on undertaking voluminous research or finding fundamental stock picks from the vast ocean of listed companies, worry not. You can simply choose to invest in curated portfolios which follow the fundamental approach and benefit from the expertise and experience offered by professional fund managers.

So, should you choose fundamental investing while creating your portfolio? Here is a comprehensive list of the benefits and disadvantages of the practice to help you decide. The first benefit of picking fundamental stock ideas is that it helps you eliminate bias when making investment decisions. Once you follow the parameters, you will only invest in stocks that live up to the hype. Secondly, the combination of qualitative and quantitative analysis ensures that you have the complete picture – of the company’s performance, as well as the sectoral and macro-economic factors impacting its future outlook. This helps you make more informed decisions based on logic and reasoning. Fundamental analysis also enables you to pick high potential stocks for longer-term investment, helping you grow your wealth sustainably.

While there are no risks to fundamental investing, a major disadvantage here is the need for extensive research and analysis. This makes fundamental investing time-consuming and complicated. If you are not a seasoned investor with a keen eye for the fundamentals, you could end up being confused by the many factors that need to be analysed. Further, many a times, the qualitative fundamentals can be very subjective, and you may find yourself unsure about the actual value of the stock pick. These disadvantages make investors vary of the approach and they end up not following it properly.

Considering the various benefits inherent in the fundamental approach to investing, it is one of the essential aspects to consider while building your portfolio. However, if you are not keen on undertaking voluminous research or finding fundamental stock picks from the vast ocean of listed companies, worry not. You can simply choose to invest in curated portfolios which follow the fundamental approach and benefit from the expertise and experience offered by professional fund managers.

So, should you choose fundamental investing while creating your portfolio? Here is a comprehensive list of the benefits and disadvantages of the practice to help you decide. The first benefit of picking fundamental stock ideas is that it helps you eliminate bias when making investment decisions. Once you follow the parameters, you will only invest in stocks that live up to the hype. Secondly, the combination of qualitative and quantitative analysis ensures that you have the complete picture – of the company’s performance, as well as the sectoral and macro-economic factors impacting its future outlook. This helps you make more informed decisions based on logic and reasoning. Fundamental analysis also enables you to pick high potential stocks for longer-term investment, helping you grow your wealth sustainably.

While there are no risks to fundamental investing, a major disadvantage here is the need for extensive research and analysis. This makes fundamental investing time-consuming and complicated. If you are not a seasoned investor with a keen eye for the fundamentals, you could end up being confused by the many factors that need to be analysed. Further, many a times, the qualitative fundamentals can be very subjective, and you may find yourself unsure about the actual value of the stock pick. These disadvantages make investors vary of the approach and they end up not following it properly.

Considering the various benefits inherent in the fundamental approach to investing, it is one of the essential aspects to consider while building your portfolio. However, if you are not keen on undertaking voluminous research or finding fundamental stock picks from the vast ocean of listed companies, worry not. You can simply choose to invest in curated portfolios which follow the fundamental approach and benefit from the expertise and experience offered by professional fund managers.

You might also Like.

All You Must Know About the Fundamental Approach to Investing

All You Must Know About the Fundamental Approach to Investing...

The short answer is wealth creation. Your salary can only get you so far. The rest of the gap can be covered with disciplined savings and investments. By investing your money, you allow it to multiply and grow over time. You also save it from getting robbed by inflation, which can eventually render your savings less valuable. However, being a young, independent individual translates to a hectic schedule in today’s times. This probably means you may not always have the time to invest in options like direct equities, where you have to build your portfolio yourself, time the market, and devise exit strategies. This is where ETFs come in as the ideal investment option.

What are ETFs?

ETFs are like a big hamper of different securities, including stocks, bonds, and commodities that tracks an underlying index. This means that an ETF follows a benchmark index and tries to replicate its performance. An ETF in India is a combination of a stock and a mutual fund. It is traded on the stock exchanges like stocks. It is also highly liquid like shares and can be bought and sold throughout the day. This means you can buy and sell units of ETFs from the stock market anytime you want.

The short answer is wealth creation. Your salary can only get you so far. The rest of the gap can be covered with disciplined savings and investments. By investing your money, you allow it to multiply and grow over time. You also save it from getting robbed by inflation, which can eventually render your savings less valuable. However, being a young, independent individual translates to a hectic schedule in today’s times. This probably means you may not always have the time to invest in options like direct equities, where you have to build your portfolio yourself, time the market, and devise exit strategies. This is where ETFs come in as the ideal investment option.

What are ETFs?

ETFs are like a big hamper of different securities, including stocks, bonds, and commodities that tracks an underlying index. This means that an ETF follows a benchmark index and tries to replicate its performance. An ETF in India is a combination of a stock and a mutual fund. It is traded on the stock exchanges like stocks. It is also highly liquid like shares and can be bought and sold throughout the day. This means you can buy and sell units of ETFs from the stock market anytime you want.

Further, it pools money from different investors, as in the case of mutual funds. The fund manager invests your money further, and the profits are given back to you as returns. ETFs also have a Net Asset Value (NAV) like mutual funds.

Some ETF examples in India include the Nippon ETF Nifty BeES, LIC MF ETF – CNX Nifty 50, and ICICI Prudential Nifty ETF, among several others. [SS1] There are also different types of ETFs like equity ETFs, gold ETFs, bond ETFs, and international ETFs. You can invest in any of these based on your financial goals.

The past, present, and future of ETFs

The Nifty Benchmark Exchange-Traded Scheme (Nifty BeES) was the first-ever ETF in India introduced in 2001. It was offered by the Benchmark Mutual Fund. This was followed by Liquid BeES in 2004, the first debt ETF in the country. However, ETFs really thrived after the economic crisis of 2008 that engulfed the world. ETFs presented investors with comparatively more security and thus appealed to beginners and experts alike.

According to AMFI, asset under management (AUM) for ETFs grew by 1345.77% between 2015 and 2020 in the country1. There was a further increase of 136% in ETF AUM between 2020 and 2022, stated a survey report by Morningstar India2. These rising numbers are testament to the fact that ETFs are attracting many investors and are indeed here to stay.

ETF benefits

Further, it pools money from different investors, as in the case of mutual funds. The fund manager invests your money further, and the profits are given back to you as returns. ETFs also have a Net Asset Value (NAV) like mutual funds.

Some ETF examples in India include the Nippon ETF Nifty BeES, LIC MF ETF – CNX Nifty 50, and ICICI Prudential Nifty ETF, among several others. [SS1] There are also different types of ETFs like equity ETFs, gold ETFs, bond ETFs, and international ETFs. You can invest in any of these based on your financial goals.

The past, present, and future of ETFs

The Nifty Benchmark Exchange-Traded Scheme (Nifty BeES) was the first-ever ETF in India introduced in 2001. It was offered by the Benchmark Mutual Fund. This was followed by Liquid BeES in 2004, the first debt ETF in the country. However, ETFs really thrived after the economic crisis of 2008 that engulfed the world. ETFs presented investors with comparatively more security and thus appealed to beginners and experts alike.

According to AMFI, asset under management (AUM) for ETFs grew by 1345.77% between 2015 and 2020 in the country1. There was a further increase of 136% in ETF AUM between 2020 and 2022, stated a survey report by Morningstar India2. These rising numbers are testament to the fact that ETFs are attracting many investors and are indeed here to stay.

ETF benefits

Here are some ETF benefits that can help you make the decision to invest in them:

Here are some ETF benefits that can help you make the decision to invest in them:

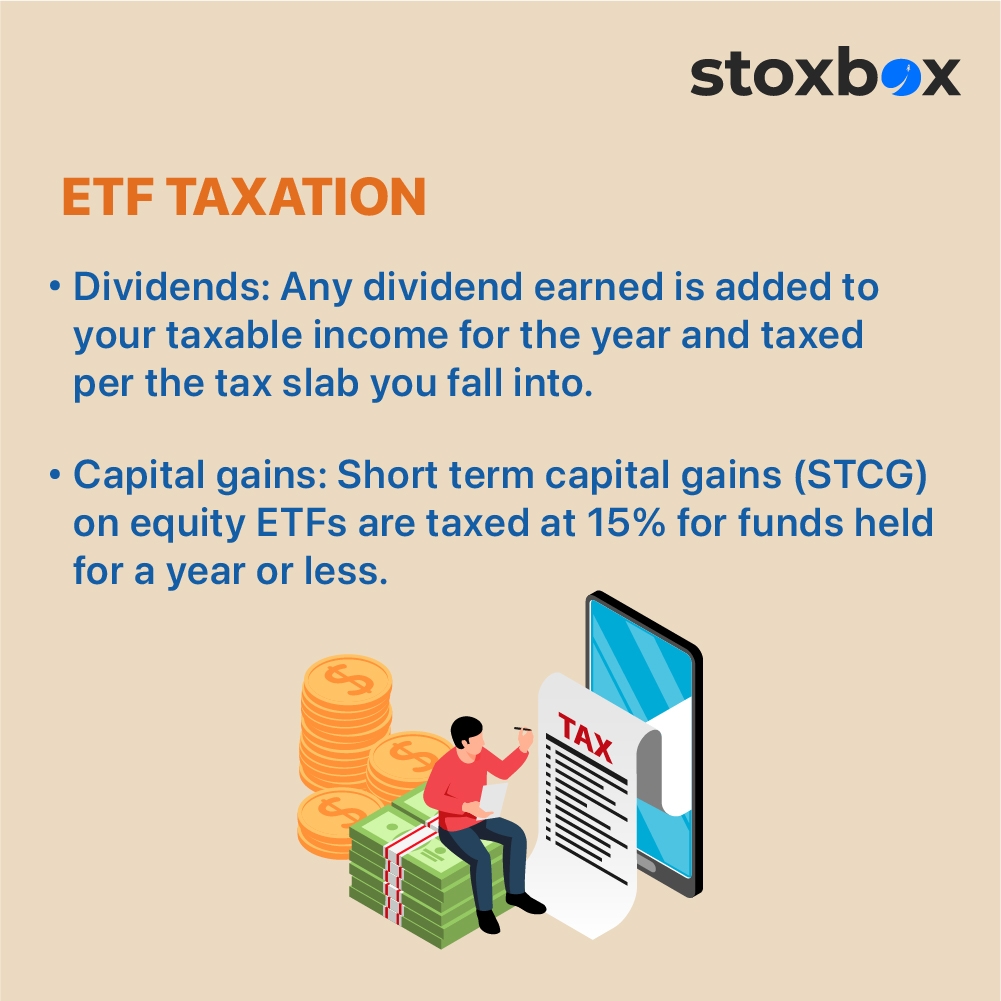

To understand ETF taxation, you first need to know that there are two types of incomes that you can earn from investing in an ETF in India – a dividend and a capital gain. Here’s how each of these is taxed:

To understand ETF taxation, you first need to know that there are two types of incomes that you can earn from investing in an ETF in India – a dividend and a capital gain. Here’s how each of these is taxed: