The financial capital of India and the city of dreams, Mumbai, is a vast metro that appeals to people from all over the country. Hailing from a smaller city and looking for growth opportunities, Mohan came to Mumbai to pursue his MBA in Operations Management. Here, he came in contact with Akshay, a stock broker and part-time lecturer who introduced him to the concept of equities and stock trading. Mohan was awe-stuck by the tales of the market and found himself allured by the potential inherent in equity investing. Once considered the playground of aggressive investors and high-risk traders, the stock market is no longer a mythical entity but a tangible reality for many Indians. With stocks worth billions being traded on a daily basis, the equity market is one of the most liquid and attractive markets in the country.

What is the market all about? It is a simple enough concept – the stocks of companies are listed on the stock exchange and traded on a daily basis. Stock market traders and investors buy and sell the stocks of these companies in the expectation that they will make money from the movement in the prices of stocks. Let us consider a simple example. In a practice session with his mentor, Mohan noticed that the price of company X, which manufactured cars, had dropped 30% due to poor earnings. He did some further research and gathered that the drop in earnings was due to a temporary shut-down in one of its key markets. The situation in that market was already improving and Mohan expected that it would be back to normal soon. So, he purchased 50 stocks at Rs. 150 each and waited for the tide to turn. 15 days later, a news article said that the company was being acquired by company Y, an international car manufacturer. This news bolstered the stocks which began rising rapidly. At the end of the day, the stock of the company was trading at Rs. 285 apiece and, upon selling, Mohan made a profit of Rs. 6,750. From then on, there was no looking back for Mohan, He was hooked. The enormous potential in equities can be seen in the rise of the Nifty index between 1996 and 2021. During its 25-year journey, the index rode from 1,107 points to 15K, offering investors 11.1% CAGR[1]. Add to it the fact that India is a growing economy with new companies being listed regularly, and the opportunity in the equity market is nothing short of tremendous.

Participating in the market

Traditionally, people have been wary of investing in the market because of a lack of knowledge and experience, a low risk appetite, and the fear of losing their savings. However, this is changing slowly and surely as a number of individuals are now participating in equities directly. While some of these investors may have a strong understanding of the market, many are dipping their toes in with the guidance of stock brokers. Stock brokers are experienced and professional traders who facilitate the buying and selling of stocks, on behalf of their investors, in return for a commission or fee. Stockbrokers like Akshay help you assess your investor personality and empower you to begin your trading journey in a guided manner, thus limiting risk and increasing the scope of potential returns. In addition to routine guidance on where to invest, they also offer you a platform and portal, allowing you to directly access the market and earn high returns.

Traditionally, people have been wary of investing in the market because of a lack of knowledge and experience, a low risk appetite, and the fear of losing their savings. However, this is changing slowly and surely as a number of individuals are now participating in equities directly. While some of these investors may have a strong understanding of the market, many are dipping their toes in with the guidance of stock brokers. Stock brokers are experienced and professional traders who facilitate the buying and selling of stocks, on behalf of their investors, in return for a commission or fee. Stockbrokers like Akshay help you assess your investor personality and empower you to begin your trading journey in a guided manner, thus limiting risk and increasing the scope of potential returns. In addition to routine guidance on where to invest, they also offer you a platform and portal, allowing you to directly access the market and earn high returns.Best stock broker for beginners in India

With the recent interest in trading and direct participation, India has seen an influx of stock brokers, both offline and online. However, when considering who is the best stock broker for beginners in India, the answer lies in your personal requirements. For Mohan, Akshay is the best stock broker for beginners in India as he has offered him guidance, advice, a trading platform, and thorough mentorship, in addition to providing access to regular research and data. You can choose from a variety of service providers and arrive at your definition of the best stock broker for beginners in India by considering the following aspects:

With the recent interest in trading and direct participation, India has seen an influx of stock brokers, both offline and online. However, when considering who is the best stock broker for beginners in India, the answer lies in your personal requirements. For Mohan, Akshay is the best stock broker for beginners in India as he has offered him guidance, advice, a trading platform, and thorough mentorship, in addition to providing access to regular research and data. You can choose from a variety of service providers and arrive at your definition of the best stock broker for beginners in India by considering the following aspects:

- Do you want a stockbroker who provides you with daily research and statistics updates, along with a proposed buy/sell list?

- Are you looking for a stockbroker who charges minimal fees while keeping you updated about relevant news?

- Or, do you want a stockbroker who acts as your personal mentor and handholds you throughout the process while offering you a curated portfolio and blanket fees for all your trades?

You might also Like.

City Union Bank Quarterly Result Update

Originally known as The Kumbakonam Bank Limited, City Union Bank...

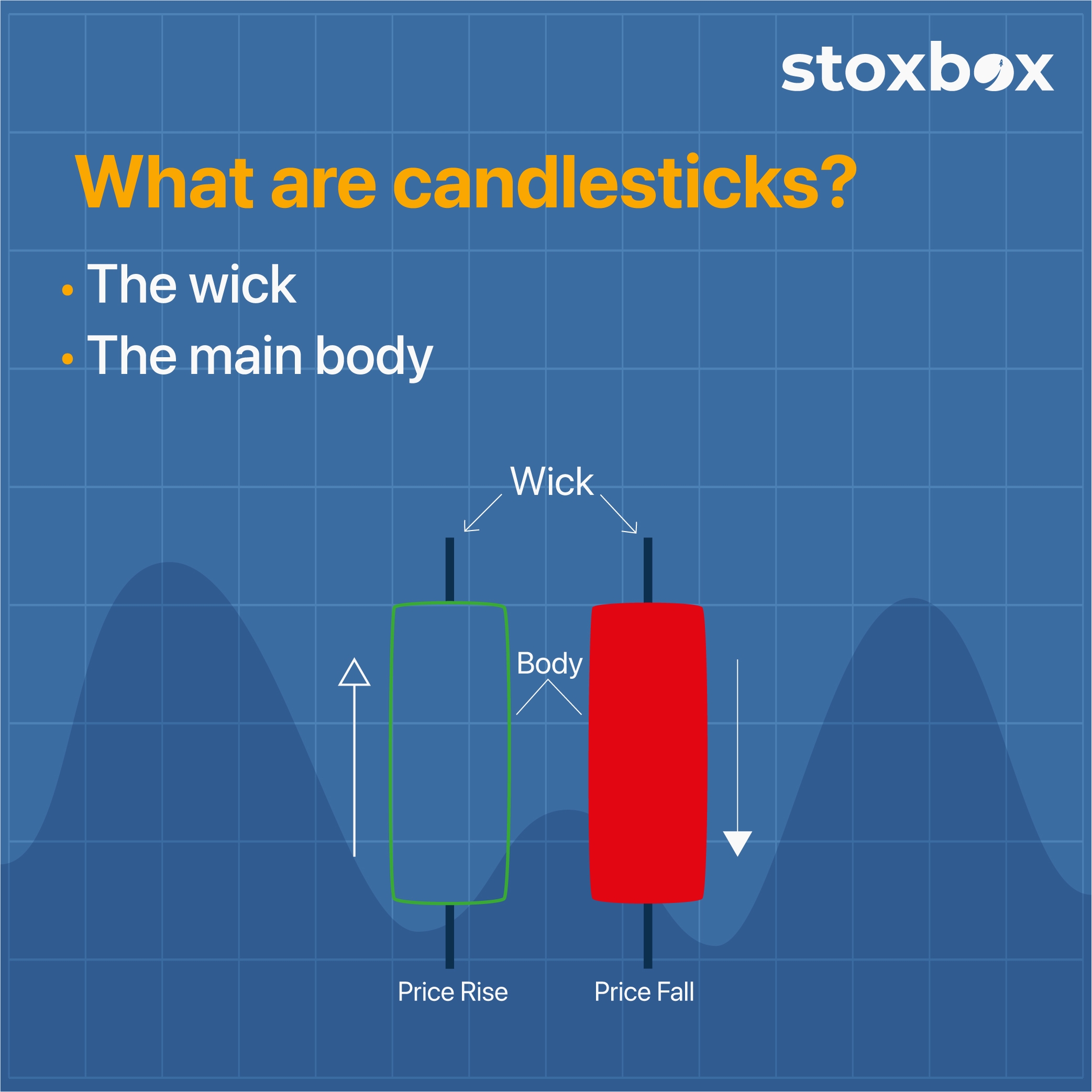

Designed by a Japanese rice trader named Homma, candlesticks were drawn in the 1700s to represent the price movement of rice on a particular trading day. Later on, these candlesticks were adapted to depict the price movement of stocks.

Candlesticks consist of two parts, the wick and the main body. Each part of the candlestick represents a particular type of data. The anatomy of a candlestick is explained below:

Beginner Guide 2022 Candlesticks Patterns

Designed by a Japanese rice trader named Homma, candlesticks were drawn in the 1700s to represent the price movement of rice on a particular trading day. Later on, these candlesticks were adapted to depict the price movement of stocks.

Candlesticks consist of two parts, the wick and the main body. Each part of the candlestick represents a particular type of data. The anatomy of a candlestick is explained below:

Beginner Guide 2022 Candlesticks Patterns

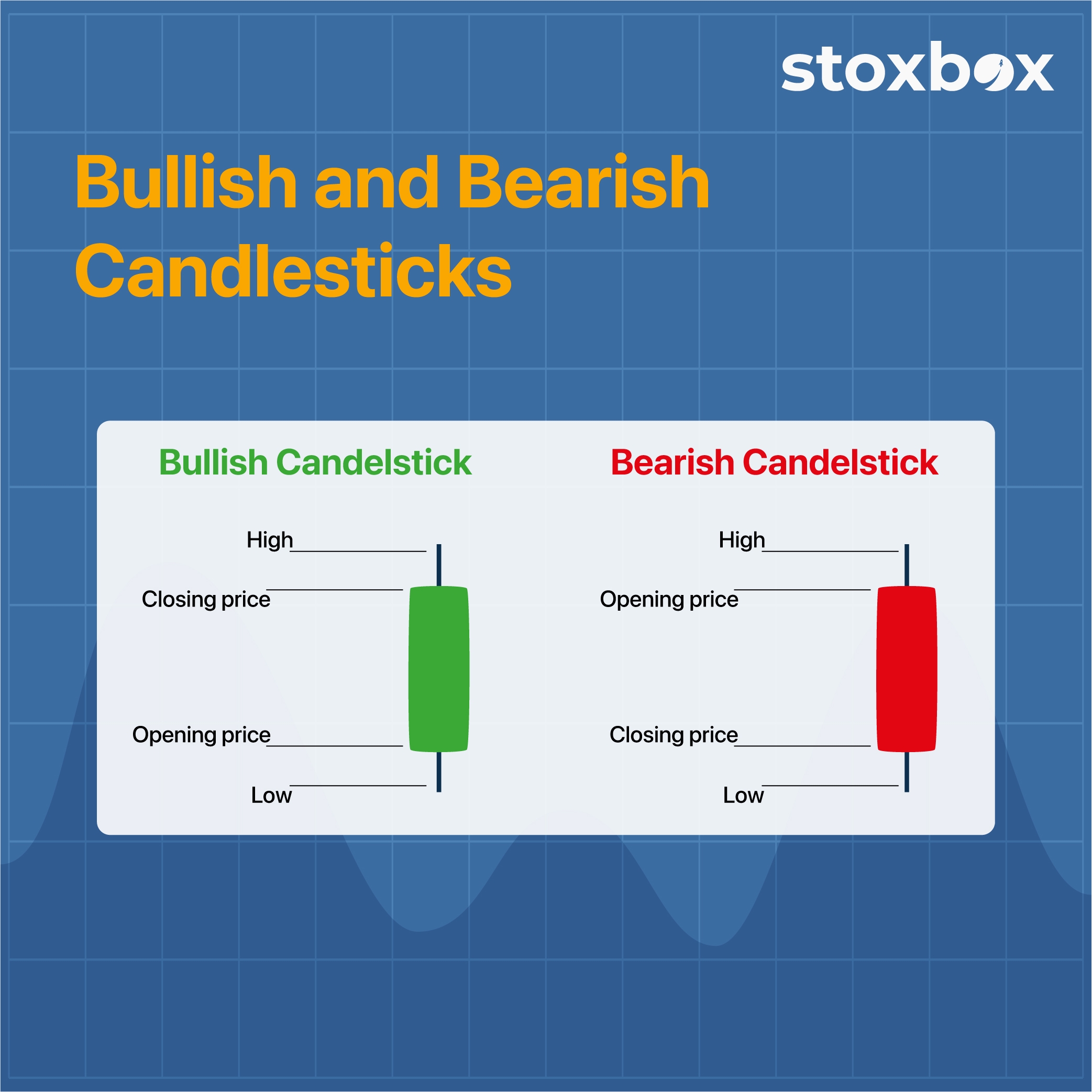

Different candlesticks are drawn for different kinds of market movements. Bullish candlesticks represent increasing prices of stock, while bearish candlesticks show decreasing or reducing prices of the stock. Bullish candlesticks are usually green or white. Bearish candlesticks, on the other hand, are either red or black. Have a look:

(Source: https://www.benzinga.com/money/how-to-read-candlestick-charts/)

Candlestick patterns: A beginner’s guide

Different candlesticks are drawn for different kinds of market movements. Bullish candlesticks represent increasing prices of stock, while bearish candlesticks show decreasing or reducing prices of the stock. Bullish candlesticks are usually green or white. Bearish candlesticks, on the other hand, are either red or black. Have a look:

(Source: https://www.benzinga.com/money/how-to-read-candlestick-charts/)

Candlestick patterns: A beginner’s guide

What is Technical Analysis Beginner Bullish Bearish Patterns

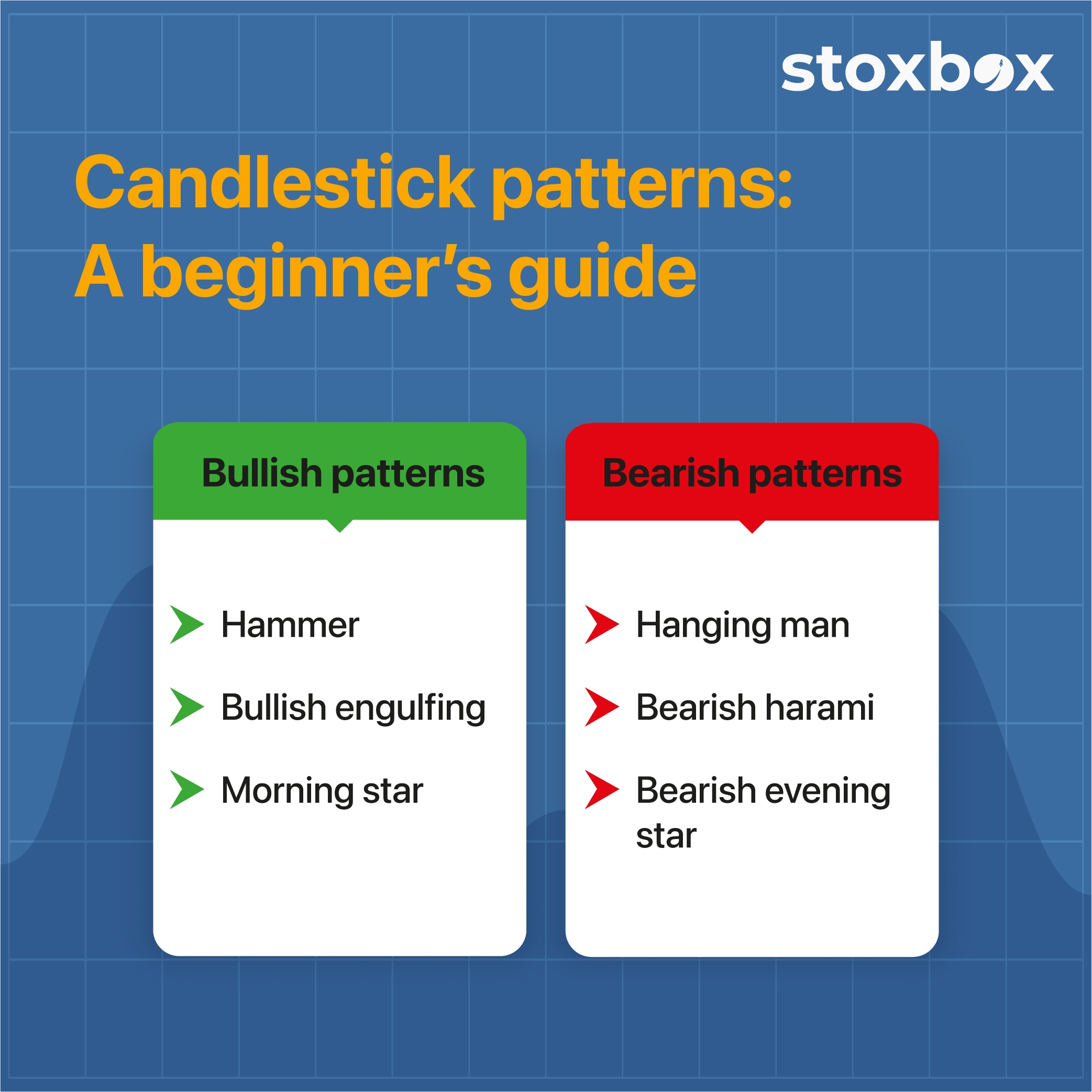

The price movement of stocks creates specific patterns which, when represented on candlesticks, become candlestick patterns. These patterns help to assess whether the stock price is expected to increase or decrease. By studying candlestick patterns, you can make trading decisions.

Candlestick patterns are of two types—bullish patterns and bearish patterns. Bullish patterns indicate a rise in prices, while bearish patterns indicate the opposite, i.e., a drop in the stock price.

While there are hundreds of candlestick patterns, some of the most popular and commonly used ones include the following:

Bullish patterns

Hammer

The bullish hammer has a short body and a long wick at the bottom, which looks like a hammer. This pattern is usually found at the bottom of a downward market trend, and it shows that though the stock had a selling pressure, there was a strong buying pressure that drove the price up. Here’s how the hammer looks:

(Source: https://www.dailyfx.com/education/candlestick-patterns/bullish-hammer.html)

Bullish engulfing

This pattern consists of two candlesticks. The first one is a short red or bearish candlestick, which is engulfed by the second, longer, bullish candlestick. The pattern shows that though the stock was bearish initially, a strong buying pressure has driven the price up considerably. Here’s a depiction of the bullish engulfing pattern:

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Morning star

There are three candlesticks in this pattern, and it is observed when a bearish trend is about to be reversed. The first candlestick is a long, bearish candlestick, and the second one is a small bullish one. The third one is a bullish candlestick that is bigger than the second but smaller than the first. Moreover, the third candle should cover at least half of the body of the first one. Thus, the pattern shows that the downward trend is about to end, and a bullish run is expected.

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Bearish patterns

Hanging man

Like the hammer pattern, this candlestick has a red or black color indicating that it is a bearish candlestick. It usually appears at the end of a bullish run showing that there was a high selling pressure. This suggests that bulls might be losing control of the market, and the stock might start losing value.

(Source: https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615)

Bearish harami

‘Harami’ is Japanese for ‘pregnant,’ and this pattern consists of two candlesticks. The first is a large bullish candlestick followed by a small-bodied bearish one. The bearish candlestick is enclosed within the body of the first one. This pattern is found at the peak of an uptrend, indicating a reversal in the stock price trend.

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Bearish evening star

This is a three candlestick pattern that signals a reversal from the bullish trend to a bearish one. In this pattern, a short bullish candlestick is seen between the first long bullish candlestick and the third long bearish candlestick. It shows that the bull run is slowing down, and a bear run is setting in.

(Source: https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615)

Interpreting the candlestick patterns

If you want to invest your money in the stock market, try to look out for these candlestick patterns to understand expected market movements. Stocks are not safe investments. They are volatile. To successfully invest in stocks you need to study the volatility, and such a study can be done through price patterns indicated in candlestick charts. So, understand the basics of the stock market before you invest in it.

To learn where to invest money for diversification, you can also use

What is Technical Analysis Beginner Bullish Bearish Patterns

The price movement of stocks creates specific patterns which, when represented on candlesticks, become candlestick patterns. These patterns help to assess whether the stock price is expected to increase or decrease. By studying candlestick patterns, you can make trading decisions.

Candlestick patterns are of two types—bullish patterns and bearish patterns. Bullish patterns indicate a rise in prices, while bearish patterns indicate the opposite, i.e., a drop in the stock price.

While there are hundreds of candlestick patterns, some of the most popular and commonly used ones include the following:

Bullish patterns

Hammer

The bullish hammer has a short body and a long wick at the bottom, which looks like a hammer. This pattern is usually found at the bottom of a downward market trend, and it shows that though the stock had a selling pressure, there was a strong buying pressure that drove the price up. Here’s how the hammer looks:

(Source: https://www.dailyfx.com/education/candlestick-patterns/bullish-hammer.html)

Bullish engulfing

This pattern consists of two candlesticks. The first one is a short red or bearish candlestick, which is engulfed by the second, longer, bullish candlestick. The pattern shows that though the stock was bearish initially, a strong buying pressure has driven the price up considerably. Here’s a depiction of the bullish engulfing pattern:

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Morning star

There are three candlesticks in this pattern, and it is observed when a bearish trend is about to be reversed. The first candlestick is a long, bearish candlestick, and the second one is a small bullish one. The third one is a bullish candlestick that is bigger than the second but smaller than the first. Moreover, the third candle should cover at least half of the body of the first one. Thus, the pattern shows that the downward trend is about to end, and a bullish run is expected.

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Bearish patterns

Hanging man

Like the hammer pattern, this candlestick has a red or black color indicating that it is a bearish candlestick. It usually appears at the end of a bullish run showing that there was a high selling pressure. This suggests that bulls might be losing control of the market, and the stock might start losing value.

(Source: https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615)

Bearish harami

‘Harami’ is Japanese for ‘pregnant,’ and this pattern consists of two candlesticks. The first is a large bullish candlestick followed by a small-bodied bearish one. The bearish candlestick is enclosed within the body of the first one. This pattern is found at the peak of an uptrend, indicating a reversal in the stock price trend.

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Bearish evening star

This is a three candlestick pattern that signals a reversal from the bullish trend to a bearish one. In this pattern, a short bullish candlestick is seen between the first long bullish candlestick and the third long bearish candlestick. It shows that the bull run is slowing down, and a bear run is setting in.

(Source: https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615)

Interpreting the candlestick patterns

If you want to invest your money in the stock market, try to look out for these candlestick patterns to understand expected market movements. Stocks are not safe investments. They are volatile. To successfully invest in stocks you need to study the volatility, and such a study can be done through price patterns indicated in candlestick charts. So, understand the basics of the stock market before you invest in it.

To learn where to invest money for diversification, you can also use