When you invest in the stock market, you need to look out for the best stocks to make the maximum gains on your investments. Stock trading requires knowledge of analyzing stocks and their profit-generating potential. One such method of analysis is a technical analysis that helps assess the stock’s future price movements based on historical patterns. Here’s a brief look into the concept of technical analysis:

What is technical analysis?

Technical analysis is the statistical analysis of the performance of a stock. The analysis is done using the historical performance of the stock based on the movements in price and trading volumes. Technical analysis is different from fundamental analysis as it uses historical and statistical data to predict stock price movements.

Technical analysis can be done using different types of charts and patterns. One such common tool of technical analysis is candlesticks and candlestick patterns. Let’s understand these tools in details:

What are candlesticks?

Designed by a Japanese rice trader named Homma, candlesticks were drawn in the 1700s to represent the price movement of rice on a particular trading day. Later on, these candlesticks were adapted to depict the price movement of stocks.

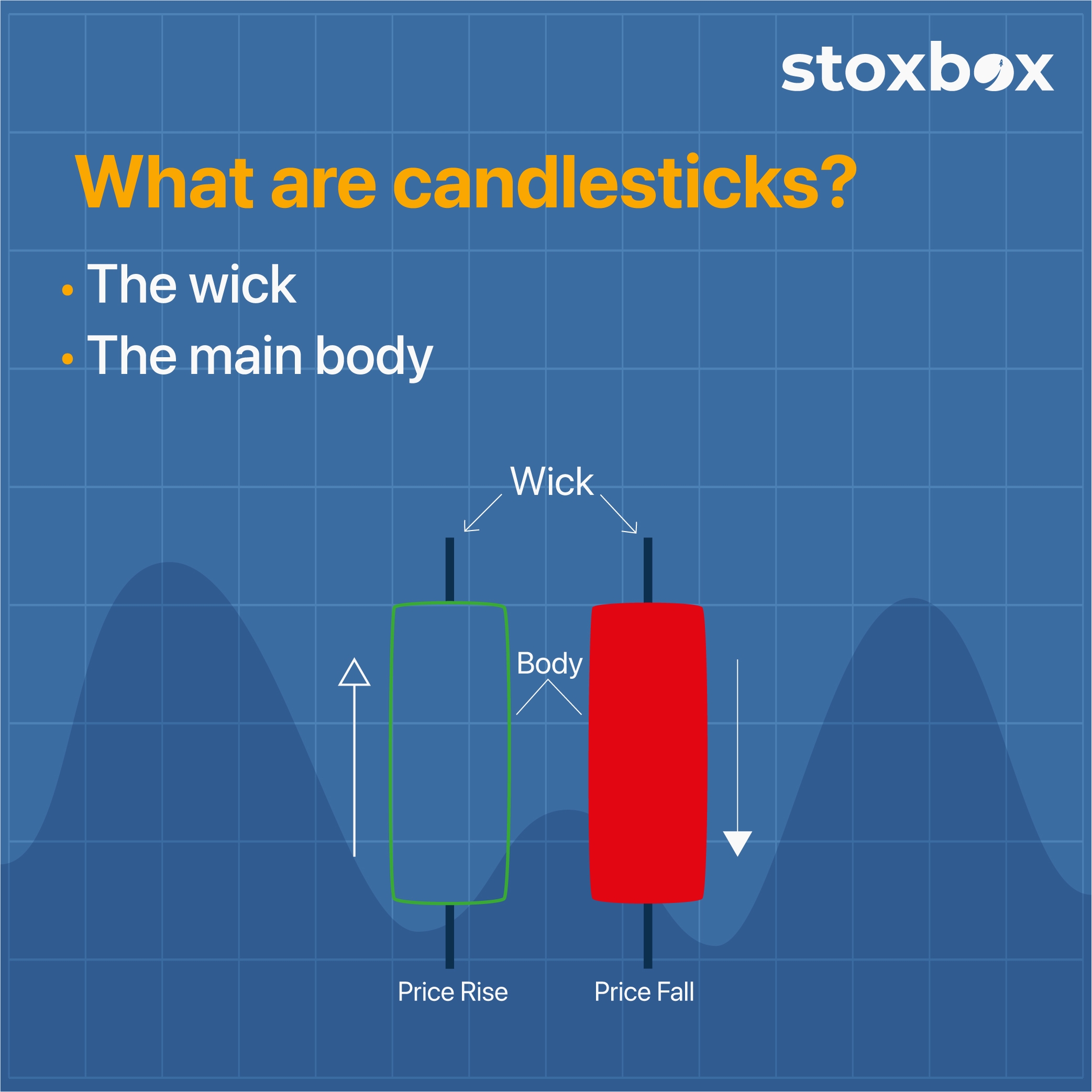

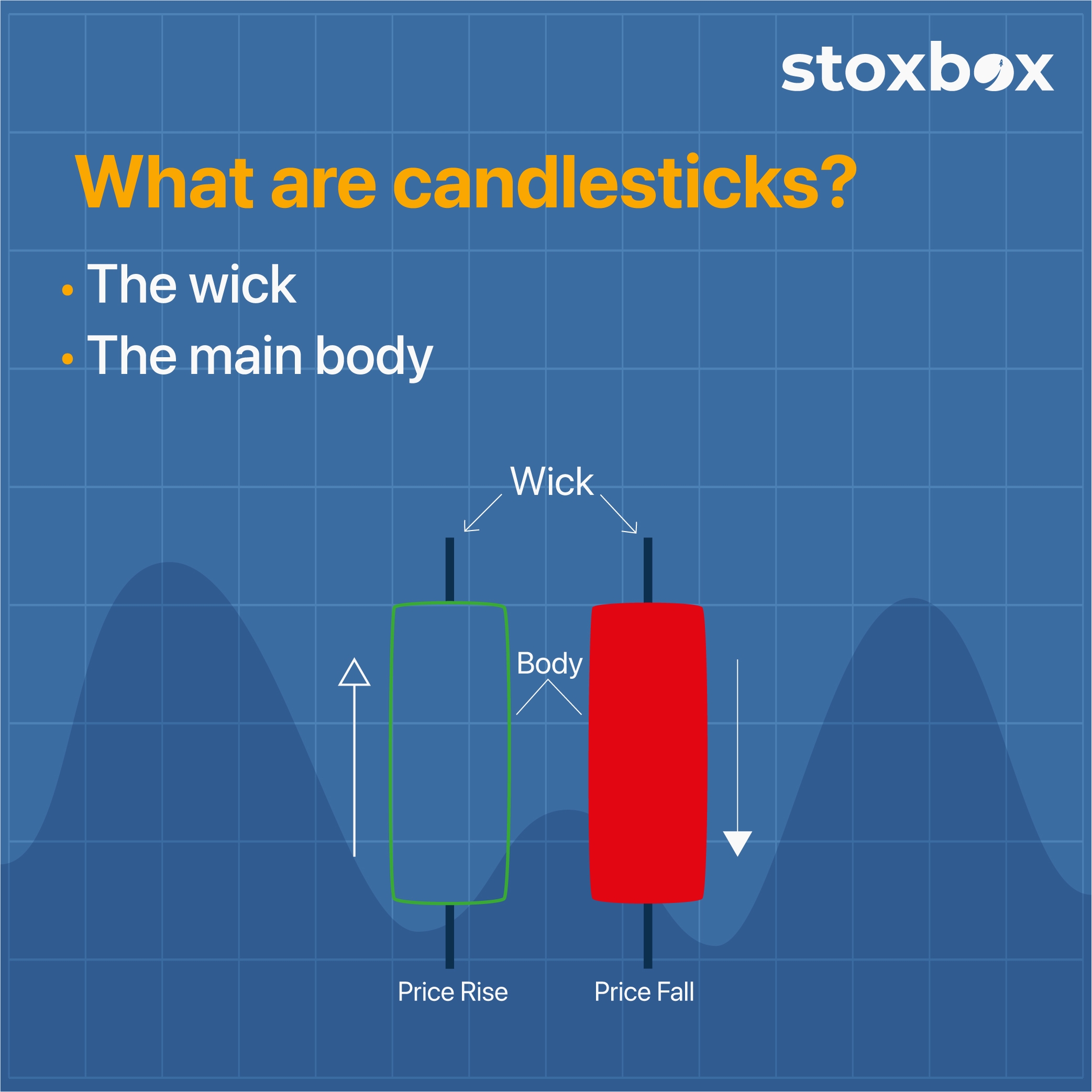

Candlesticks consist of two parts, the wick and the main body. Each part of the candlestick represents a particular type of data. The anatomy of a candlestick is explained below:

Beginner Guide 2022 Candlesticks Patterns

Designed by a Japanese rice trader named Homma, candlesticks were drawn in the 1700s to represent the price movement of rice on a particular trading day. Later on, these candlesticks were adapted to depict the price movement of stocks.

Candlesticks consist of two parts, the wick and the main body. Each part of the candlestick represents a particular type of data. The anatomy of a candlestick is explained below:

Beginner Guide 2022 Candlesticks Patterns

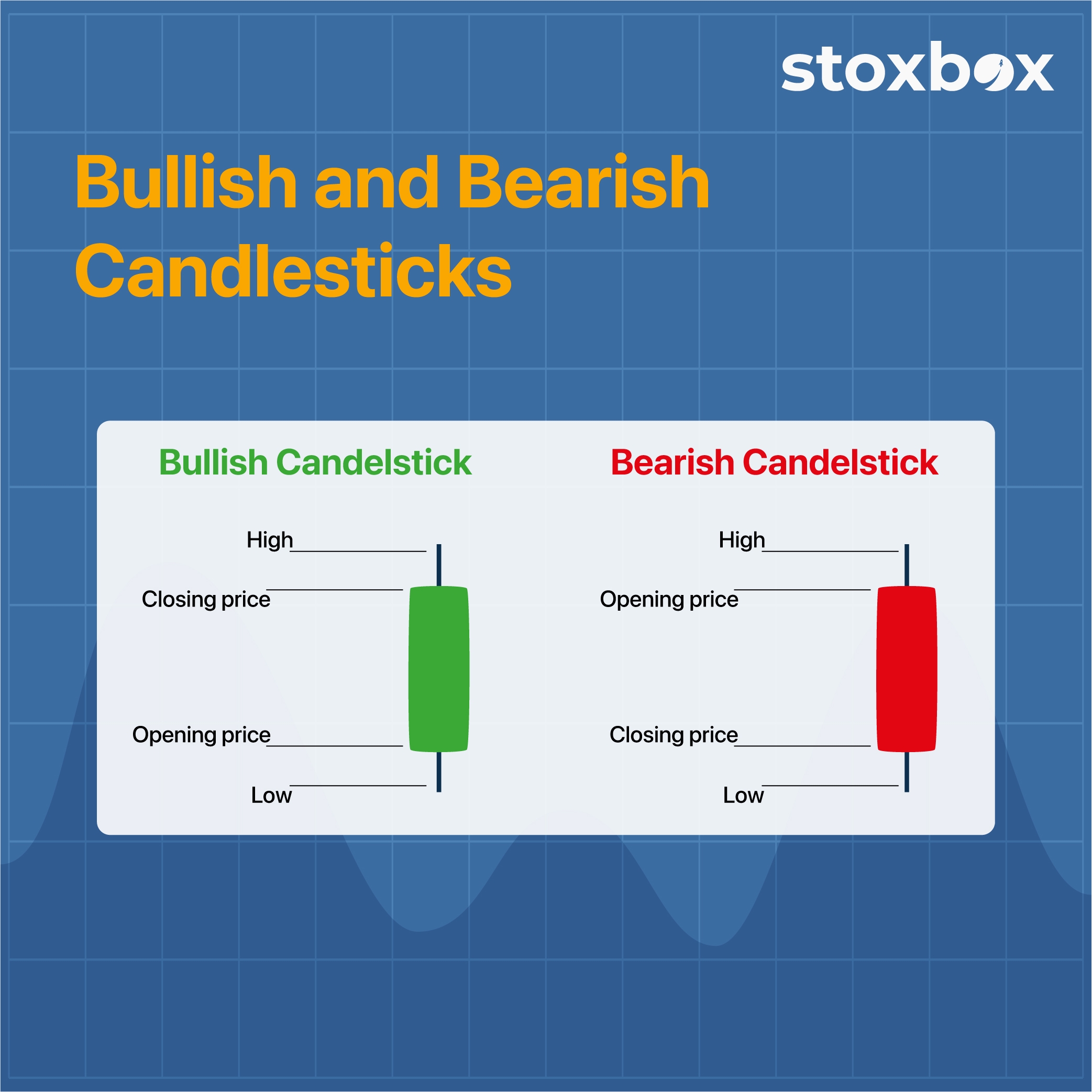

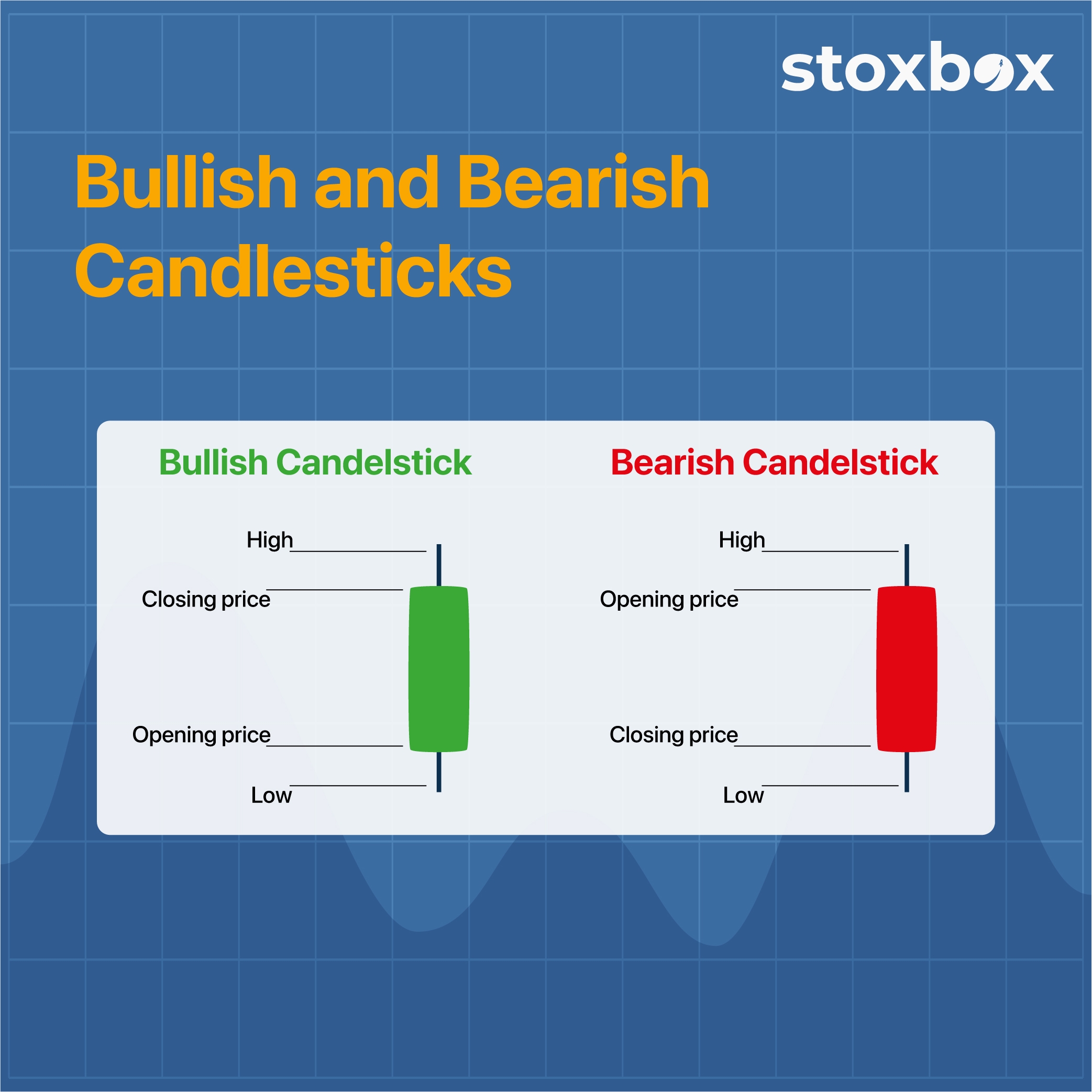

Different candlesticks are drawn for different kinds of market movements. Bullish candlesticks represent increasing prices of stock, while bearish candlesticks show decreasing or reducing prices of the stock. Bullish candlesticks are usually green or white. Bearish candlesticks, on the other hand, are either red or black. Have a look:

(Source: https://www.benzinga.com/money/how-to-read-candlestick-charts/)

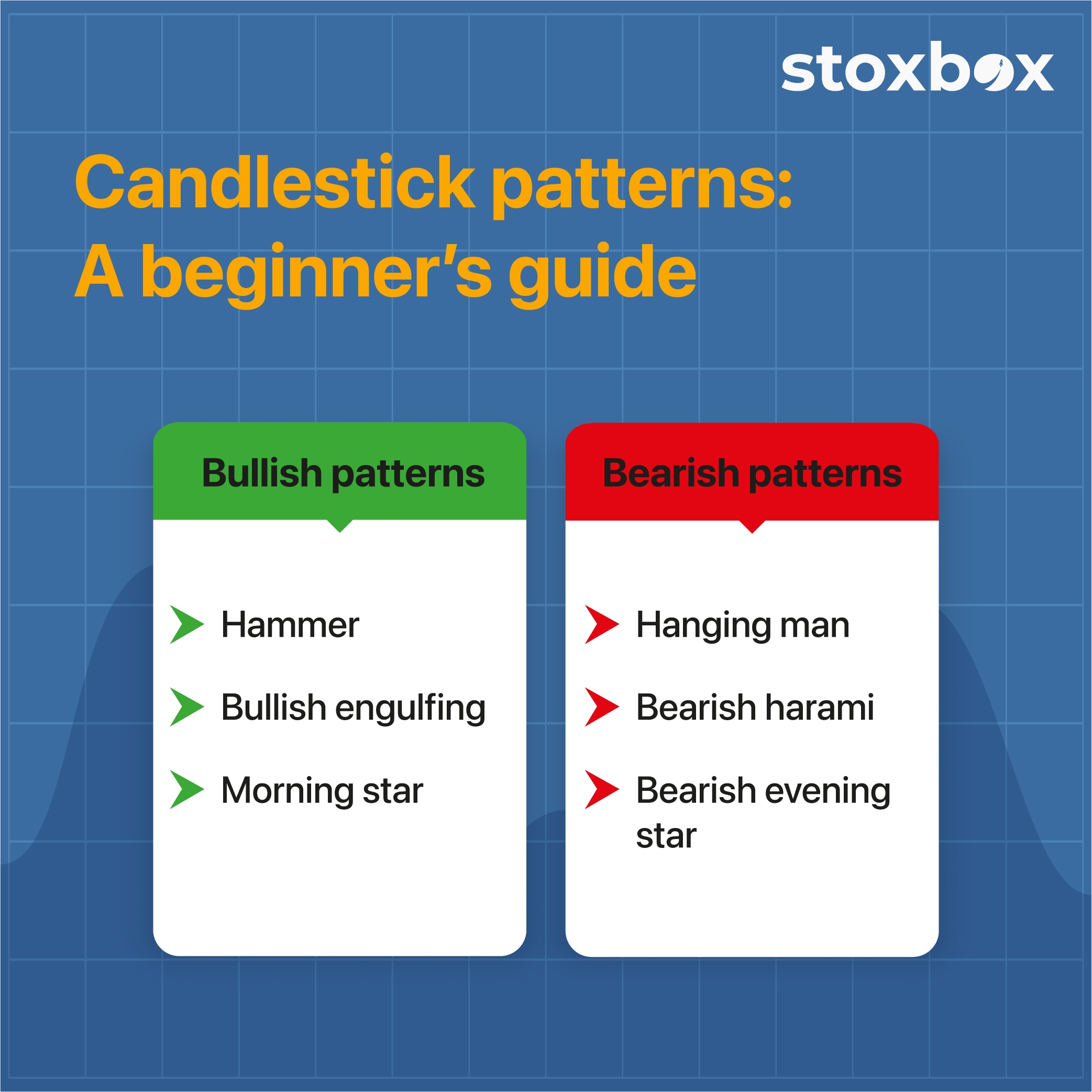

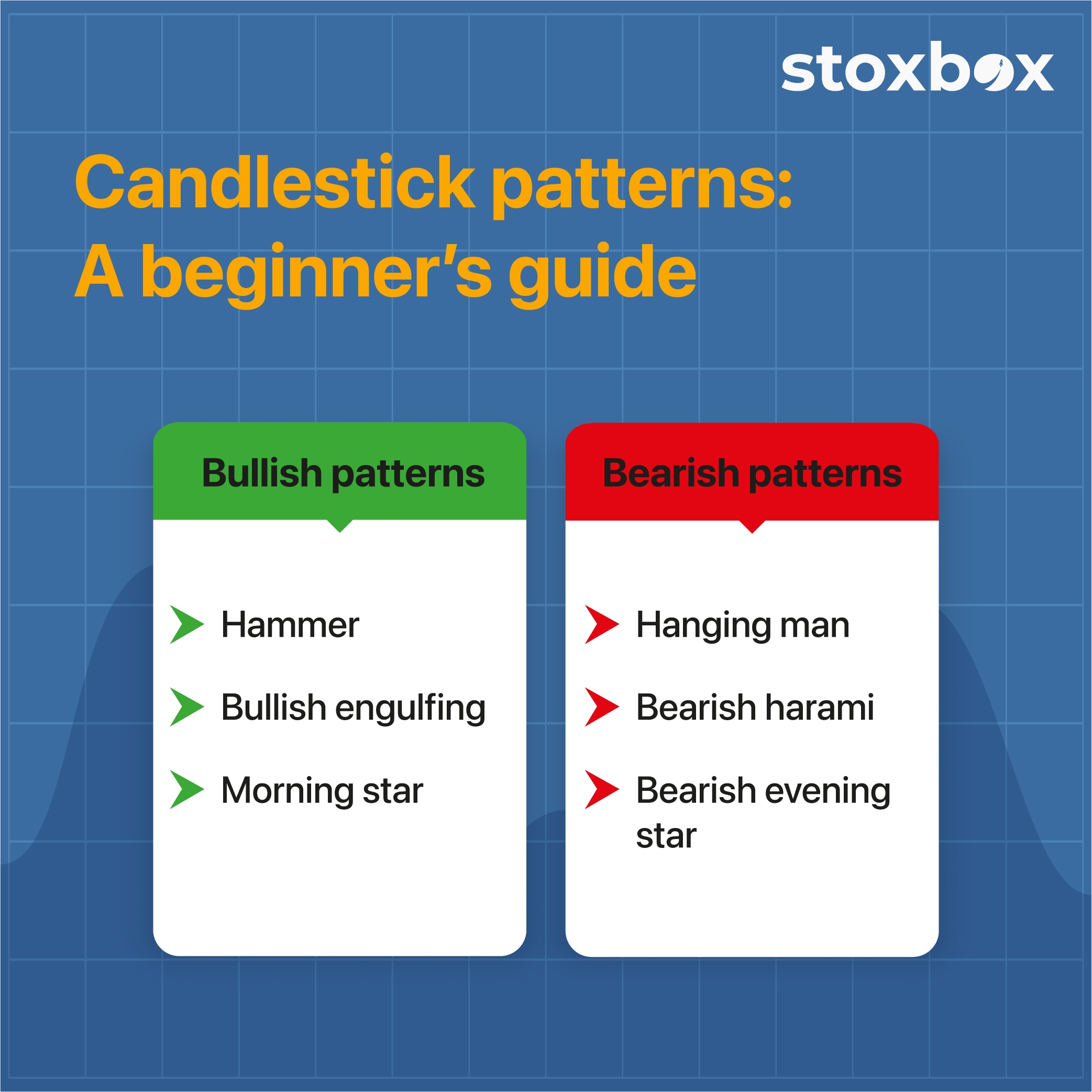

Candlestick patterns: A beginner’s guide

Different candlesticks are drawn for different kinds of market movements. Bullish candlesticks represent increasing prices of stock, while bearish candlesticks show decreasing or reducing prices of the stock. Bullish candlesticks are usually green or white. Bearish candlesticks, on the other hand, are either red or black. Have a look:

(Source: https://www.benzinga.com/money/how-to-read-candlestick-charts/)

Candlestick patterns: A beginner’s guide

What is Technical Analysis Beginner Bullish Bearish Patterns

The price movement of stocks creates specific patterns which, when represented on candlesticks, become candlestick patterns. These patterns help to assess whether the stock price is expected to increase or decrease. By studying candlestick patterns, you can make trading decisions.

Candlestick patterns are of two types—bullish patterns and bearish patterns. Bullish patterns indicate a rise in prices, while bearish patterns indicate the opposite, i.e., a drop in the stock price.

While there are hundreds of candlestick patterns, some of the most popular and commonly used ones include the following:

Bullish patterns

Hammer

The bullish hammer has a short body and a long wick at the bottom, which looks like a hammer. This pattern is usually found at the bottom of a downward market trend, and it shows that though the stock had a selling pressure, there was a strong buying pressure that drove the price up. Here’s how the hammer looks:

(Source: https://www.dailyfx.com/education/candlestick-patterns/bullish-hammer.html)

Bullish engulfing

This pattern consists of two candlesticks. The first one is a short red or bearish candlestick, which is engulfed by the second, longer, bullish candlestick. The pattern shows that though the stock was bearish initially, a strong buying pressure has driven the price up considerably. Here’s a depiction of the bullish engulfing pattern:

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Morning star

There are three candlesticks in this pattern, and it is observed when a bearish trend is about to be reversed. The first candlestick is a long, bearish candlestick, and the second one is a small bullish one. The third one is a bullish candlestick that is bigger than the second but smaller than the first. Moreover, the third candle should cover at least half of the body of the first one. Thus, the pattern shows that the downward trend is about to end, and a bullish run is expected.

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Bearish patterns

Hanging man

Like the hammer pattern, this candlestick has a red or black color indicating that it is a bearish candlestick. It usually appears at the end of a bullish run showing that there was a high selling pressure. This suggests that bulls might be losing control of the market, and the stock might start losing value.

(Source: https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615)

Bearish harami

‘Harami’ is Japanese for ‘pregnant,’ and this pattern consists of two candlesticks. The first is a large bullish candlestick followed by a small-bodied bearish one. The bearish candlestick is enclosed within the body of the first one. This pattern is found at the peak of an uptrend, indicating a reversal in the stock price trend.

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Bearish evening star

This is a three candlestick pattern that signals a reversal from the bullish trend to a bearish one. In this pattern, a short bullish candlestick is seen between the first long bullish candlestick and the third long bearish candlestick. It shows that the bull run is slowing down, and a bear run is setting in.

(Source: https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615)

Interpreting the candlestick patterns

If you want to invest your money in the stock market, try to look out for these candlestick patterns to understand expected market movements. Stocks are not safe investments. They are volatile. To successfully invest in stocks you need to study the volatility, and such a study can be done through price patterns indicated in candlestick charts. So, understand the basics of the stock market before you invest in it.

To learn where to invest money for diversification, you can also use Stoxbox. Stoxbox gives you a combination of different investment options in India, including stocks that are picked using technical and fundamental analysis. You can, therefore, expose your portfolio to different types of investments and maximize returns.

Be careful when trading in stocks. Know the rules of trading in the stock market, use the candlestick patterns to identify trading opportunities, and then invest for maximum gains.

What is Technical Analysis Beginner Bullish Bearish Patterns

The price movement of stocks creates specific patterns which, when represented on candlesticks, become candlestick patterns. These patterns help to assess whether the stock price is expected to increase or decrease. By studying candlestick patterns, you can make trading decisions.

Candlestick patterns are of two types—bullish patterns and bearish patterns. Bullish patterns indicate a rise in prices, while bearish patterns indicate the opposite, i.e., a drop in the stock price.

While there are hundreds of candlestick patterns, some of the most popular and commonly used ones include the following:

Bullish patterns

Hammer

The bullish hammer has a short body and a long wick at the bottom, which looks like a hammer. This pattern is usually found at the bottom of a downward market trend, and it shows that though the stock had a selling pressure, there was a strong buying pressure that drove the price up. Here’s how the hammer looks:

(Source: https://www.dailyfx.com/education/candlestick-patterns/bullish-hammer.html)

Bullish engulfing

This pattern consists of two candlesticks. The first one is a short red or bearish candlestick, which is engulfed by the second, longer, bullish candlestick. The pattern shows that though the stock was bearish initially, a strong buying pressure has driven the price up considerably. Here’s a depiction of the bullish engulfing pattern:

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Morning star

There are three candlesticks in this pattern, and it is observed when a bearish trend is about to be reversed. The first candlestick is a long, bearish candlestick, and the second one is a small bullish one. The third one is a bullish candlestick that is bigger than the second but smaller than the first. Moreover, the third candle should cover at least half of the body of the first one. Thus, the pattern shows that the downward trend is about to end, and a bullish run is expected.

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Bearish patterns

Hanging man

Like the hammer pattern, this candlestick has a red or black color indicating that it is a bearish candlestick. It usually appears at the end of a bullish run showing that there was a high selling pressure. This suggests that bulls might be losing control of the market, and the stock might start losing value.

(Source: https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615)

Bearish harami

‘Harami’ is Japanese for ‘pregnant,’ and this pattern consists of two candlesticks. The first is a large bullish candlestick followed by a small-bodied bearish one. The bearish candlestick is enclosed within the body of the first one. This pattern is found at the peak of an uptrend, indicating a reversal in the stock price trend.

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Bearish evening star

This is a three candlestick pattern that signals a reversal from the bullish trend to a bearish one. In this pattern, a short bullish candlestick is seen between the first long bullish candlestick and the third long bearish candlestick. It shows that the bull run is slowing down, and a bear run is setting in.

(Source: https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615)

Interpreting the candlestick patterns

If you want to invest your money in the stock market, try to look out for these candlestick patterns to understand expected market movements. Stocks are not safe investments. They are volatile. To successfully invest in stocks you need to study the volatility, and such a study can be done through price patterns indicated in candlestick charts. So, understand the basics of the stock market before you invest in it.

To learn where to invest money for diversification, you can also use Stoxbox. Stoxbox gives you a combination of different investment options in India, including stocks that are picked using technical and fundamental analysis. You can, therefore, expose your portfolio to different types of investments and maximize returns.

Be careful when trading in stocks. Know the rules of trading in the stock market, use the candlestick patterns to identify trading opportunities, and then invest for maximum gains.

Designed by a Japanese rice trader named Homma, candlesticks were drawn in the 1700s to represent the price movement of rice on a particular trading day. Later on, these candlesticks were adapted to depict the price movement of stocks.

Candlesticks consist of two parts, the wick and the main body. Each part of the candlestick represents a particular type of data. The anatomy of a candlestick is explained below:

Beginner Guide 2022 Candlesticks Patterns

Designed by a Japanese rice trader named Homma, candlesticks were drawn in the 1700s to represent the price movement of rice on a particular trading day. Later on, these candlesticks were adapted to depict the price movement of stocks.

Candlesticks consist of two parts, the wick and the main body. Each part of the candlestick represents a particular type of data. The anatomy of a candlestick is explained below:

Beginner Guide 2022 Candlesticks Patterns

- The wick

- The main body

Different candlesticks are drawn for different kinds of market movements. Bullish candlesticks represent increasing prices of stock, while bearish candlesticks show decreasing or reducing prices of the stock. Bullish candlesticks are usually green or white. Bearish candlesticks, on the other hand, are either red or black. Have a look:

(Source: https://www.benzinga.com/money/how-to-read-candlestick-charts/)

Candlestick patterns: A beginner’s guide

Different candlesticks are drawn for different kinds of market movements. Bullish candlesticks represent increasing prices of stock, while bearish candlesticks show decreasing or reducing prices of the stock. Bullish candlesticks are usually green or white. Bearish candlesticks, on the other hand, are either red or black. Have a look:

(Source: https://www.benzinga.com/money/how-to-read-candlestick-charts/)

Candlestick patterns: A beginner’s guide

What is Technical Analysis Beginner Bullish Bearish Patterns

The price movement of stocks creates specific patterns which, when represented on candlesticks, become candlestick patterns. These patterns help to assess whether the stock price is expected to increase or decrease. By studying candlestick patterns, you can make trading decisions.

Candlestick patterns are of two types—bullish patterns and bearish patterns. Bullish patterns indicate a rise in prices, while bearish patterns indicate the opposite, i.e., a drop in the stock price.

While there are hundreds of candlestick patterns, some of the most popular and commonly used ones include the following:

Bullish patterns

Hammer

The bullish hammer has a short body and a long wick at the bottom, which looks like a hammer. This pattern is usually found at the bottom of a downward market trend, and it shows that though the stock had a selling pressure, there was a strong buying pressure that drove the price up. Here’s how the hammer looks:

(Source: https://www.dailyfx.com/education/candlestick-patterns/bullish-hammer.html)

Bullish engulfing

This pattern consists of two candlesticks. The first one is a short red or bearish candlestick, which is engulfed by the second, longer, bullish candlestick. The pattern shows that though the stock was bearish initially, a strong buying pressure has driven the price up considerably. Here’s a depiction of the bullish engulfing pattern:

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Morning star

There are three candlesticks in this pattern, and it is observed when a bearish trend is about to be reversed. The first candlestick is a long, bearish candlestick, and the second one is a small bullish one. The third one is a bullish candlestick that is bigger than the second but smaller than the first. Moreover, the third candle should cover at least half of the body of the first one. Thus, the pattern shows that the downward trend is about to end, and a bullish run is expected.

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Bearish patterns

Hanging man

Like the hammer pattern, this candlestick has a red or black color indicating that it is a bearish candlestick. It usually appears at the end of a bullish run showing that there was a high selling pressure. This suggests that bulls might be losing control of the market, and the stock might start losing value.

(Source: https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615)

Bearish harami

‘Harami’ is Japanese for ‘pregnant,’ and this pattern consists of two candlesticks. The first is a large bullish candlestick followed by a small-bodied bearish one. The bearish candlestick is enclosed within the body of the first one. This pattern is found at the peak of an uptrend, indicating a reversal in the stock price trend.

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Bearish evening star

This is a three candlestick pattern that signals a reversal from the bullish trend to a bearish one. In this pattern, a short bullish candlestick is seen between the first long bullish candlestick and the third long bearish candlestick. It shows that the bull run is slowing down, and a bear run is setting in.

(Source: https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615)

Interpreting the candlestick patterns

If you want to invest your money in the stock market, try to look out for these candlestick patterns to understand expected market movements. Stocks are not safe investments. They are volatile. To successfully invest in stocks you need to study the volatility, and such a study can be done through price patterns indicated in candlestick charts. So, understand the basics of the stock market before you invest in it.

To learn where to invest money for diversification, you can also use Stoxbox. Stoxbox gives you a combination of different investment options in India, including stocks that are picked using technical and fundamental analysis. You can, therefore, expose your portfolio to different types of investments and maximize returns.

Be careful when trading in stocks. Know the rules of trading in the stock market, use the candlestick patterns to identify trading opportunities, and then invest for maximum gains.

What is Technical Analysis Beginner Bullish Bearish Patterns

The price movement of stocks creates specific patterns which, when represented on candlesticks, become candlestick patterns. These patterns help to assess whether the stock price is expected to increase or decrease. By studying candlestick patterns, you can make trading decisions.

Candlestick patterns are of two types—bullish patterns and bearish patterns. Bullish patterns indicate a rise in prices, while bearish patterns indicate the opposite, i.e., a drop in the stock price.

While there are hundreds of candlestick patterns, some of the most popular and commonly used ones include the following:

Bullish patterns

Hammer

The bullish hammer has a short body and a long wick at the bottom, which looks like a hammer. This pattern is usually found at the bottom of a downward market trend, and it shows that though the stock had a selling pressure, there was a strong buying pressure that drove the price up. Here’s how the hammer looks:

(Source: https://www.dailyfx.com/education/candlestick-patterns/bullish-hammer.html)

Bullish engulfing

This pattern consists of two candlesticks. The first one is a short red or bearish candlestick, which is engulfed by the second, longer, bullish candlestick. The pattern shows that though the stock was bearish initially, a strong buying pressure has driven the price up considerably. Here’s a depiction of the bullish engulfing pattern:

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Morning star

There are three candlesticks in this pattern, and it is observed when a bearish trend is about to be reversed. The first candlestick is a long, bearish candlestick, and the second one is a small bullish one. The third one is a bullish candlestick that is bigger than the second but smaller than the first. Moreover, the third candle should cover at least half of the body of the first one. Thus, the pattern shows that the downward trend is about to end, and a bullish run is expected.

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Bearish patterns

Hanging man

Like the hammer pattern, this candlestick has a red or black color indicating that it is a bearish candlestick. It usually appears at the end of a bullish run showing that there was a high selling pressure. This suggests that bulls might be losing control of the market, and the stock might start losing value.

(Source: https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615)

Bearish harami

‘Harami’ is Japanese for ‘pregnant,’ and this pattern consists of two candlesticks. The first is a large bullish candlestick followed by a small-bodied bearish one. The bearish candlestick is enclosed within the body of the first one. This pattern is found at the peak of an uptrend, indicating a reversal in the stock price trend.

(Source: https://www.dailyfx.com/education/candlestick-patterns/top-10.html)

Bearish evening star

This is a three candlestick pattern that signals a reversal from the bullish trend to a bearish one. In this pattern, a short bullish candlestick is seen between the first long bullish candlestick and the third long bearish candlestick. It shows that the bull run is slowing down, and a bear run is setting in.

(Source: https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615)

Interpreting the candlestick patterns

If you want to invest your money in the stock market, try to look out for these candlestick patterns to understand expected market movements. Stocks are not safe investments. They are volatile. To successfully invest in stocks you need to study the volatility, and such a study can be done through price patterns indicated in candlestick charts. So, understand the basics of the stock market before you invest in it.

To learn where to invest money for diversification, you can also use Stoxbox. Stoxbox gives you a combination of different investment options in India, including stocks that are picked using technical and fundamental analysis. You can, therefore, expose your portfolio to different types of investments and maximize returns.

Be careful when trading in stocks. Know the rules of trading in the stock market, use the candlestick patterns to identify trading opportunities, and then invest for maximum gains. You might also Like.

City Union Bank Quarterly Result Update

Originally known as The Kumbakonam Bank Limited, City Union Bank...